Initiatives Supporting Public Funding Landscape

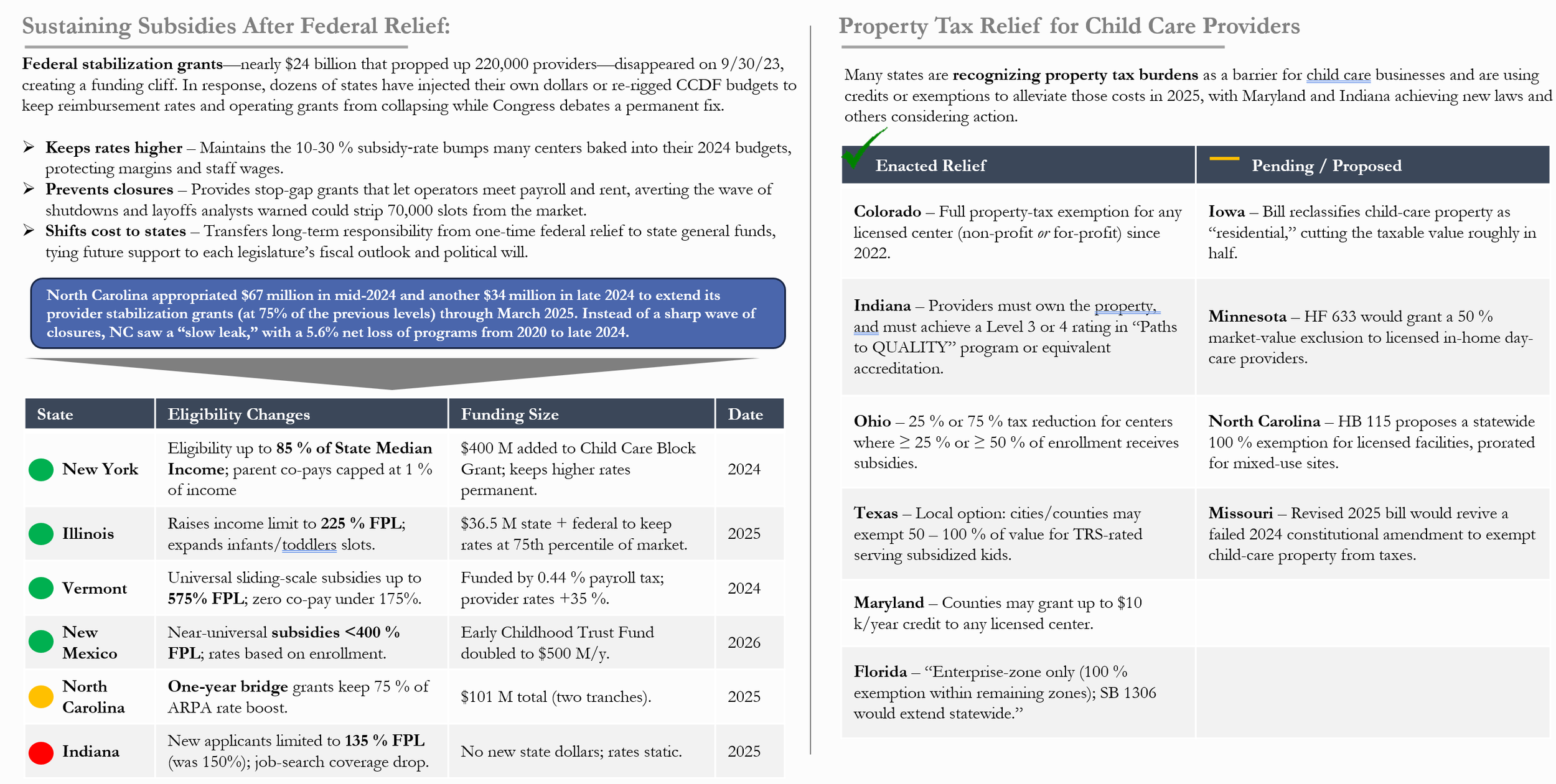

States are rapidly reshaping the early‑education funding map now that the federal COVID‑era stabilization grants— $24 billion that propped up 220,000 providers—expired last September. To blunt a feared “funding cliff,” dozens of legislatures have redirected child‑care block‑grant dollars or approved new general‑fund appropriations so providers can keep the 10‑30 % reimbursement‑rate increases they built into 2024 budgets, cover payroll and rent, and avoid mass closures. North Carolina’s strategy is emblematic: the state injected $101 million across two tranches to extend stabilization payments through March 2025, limiting its program loss to a slow 5.6 % leak rather than a sudden wave of shutdowns.

At the same time, many states are broadening who qualifies for subsidies and how generous those subsidies are. New York now covers families earning up to 85 % of the state median income and caps parent copays at 1 %—funded by an extra $400 million in its Child Care Block Grant. Vermont went further, adopting a universal sliding‑scale model that reaches families at 575 % of the federal poverty level, financed by a 0.44 % payroll tax and coupled with a 35 % bump to provider rates. Illinois, New Mexico, and others have similarly widened eligibility or poured hundreds of millions into keeping rates at—or above—the 75th percentile of market tuition. Not every state is expanding, however: Indiana trimmed eligibility thresholds and added no new money, leaving reimbursement rates flat.

Rising property‑tax bills have become another cost‑pressure target. Six states already offer meaningful relief. Colorado grants a full property‑tax exemption to any licensed center—non‑profit or for‑profit—while Ohio reduces taxes by 25 % or 75 % for providers serving large shares of subsidized children. Indiana ties its new exemption to quality‑rating benchmarks, and Texas lets cities and counties wipe out up to 100 % of taxable value for high‑rated centers. Maryland delivers up to a $10,000 annual credit, and Florida offers a 100 % break inside former enterprise zones, with legislation pending to extend it statewide.

Momentum is building for more. Bills in Iowa, Minnesota, North Carolina, and Missouri would slash or eliminate property taxes for licensed facilities—proposals that could meaningfully improve operating margins if enacted. Together with the subsidy expansions, these measures signal that the long‑term burden of shoring up the child‑care sector is shifting from one‑off federal relief to a patchwork of state budgets and tax codes—creating both lifelines and new uncertainties for providers and investors alike.

About SchoolWise Partners

SchoolWise Partners (SwP) is the nation's leading sell-side advisory firm that provides strategic services to owners and operators of preschools, primary, and secondary schools. SwP's principals and its team have deep experience as former owners of 42 private schools combined with profound institutional knowledge in the fields of finance, private equity, investment banking, and accounting. It is uniquely positioned as the premier sell-side advisor to school owners and, since its founding, SwP has helped hundreds of owners throughout the U.S. realize value in excess of $900 million.

SchoolWise Partners' passion for education inspires us to not only create value for our clients. We exclusively assist owners of early childhood, primary, and secondary school owners realize value that is often left behind because they are under-represented. SwP's mission is to ensure all the hard work that school owners invest to educate America's children is returned to them at the appropriate time and in the appropriate manner. We strive to embody the highest standards of integrity, excellence, commitment, stewardship, and partnership.

If you have any questions, feel free to contact the SchoolWise team at info@schoolwisepartners.com.